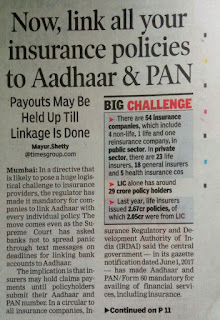

On 08th November 2017, IRDA (Insurance Regulatory And Development Authority of India) issued a Circular No.IRDAI/SDD/MISC/CIR/248/11/2017 that linking your Aadhar No. and PAN is mandatory with all your insurance policies. Read this Circular is as below :

"Central Government vide gazette notification dated 1st June 2017 notified the Prevention of Money-laundering (Maintenance of Records) Second Amendment Rules, 2017 making Aaadhar and PAN/Form 60 mandatory for availing financial services including Insurance and also for linking the existing policies with the same.

"Central Government vide gazette notification dated 1st June 2017 notified the Prevention of Money-laundering (Maintenance of Records) Second Amendment Rules, 2017 making Aaadhar and PAN/Form 60 mandatory for availing financial services including Insurance and also for linking the existing policies with the same.

The Authority clarifies that, linkage of Aadhaar number to Insurance Policies is mandatory under the Prevention of Money-laundering (Maintenance of Records) Second Amendment Rules, 2017.

These Rules have statutory force and, as such, Life and General Insurers (Including Standalone Health Insurers) have to implement them without awaiting further instructions".

Why it is became so important to all policy holder? It is just to save your investment from any future fraud. We have to understand the importance to link Aadhar to LIC Policies and Linking of PAN to all insurance policies you are having.

However the question is, How to link Aadhar No. to LIC Policies? Neither IRDA nor LIC company provided any facility to link their policies with Aadhar. Though there are two ways that you can link your Aadhar no with your insurance policies.

However the question is, How to link Aadhar No. to LIC Policies? Neither IRDA nor LIC company provided any facility to link their policies with Aadhar. Though there are two ways that you can link your Aadhar no with your insurance policies.

1. Link Aadhar / PAN while buying New Policy:

If you are planning to buy any new insurance policy then there are facility to link your Aadhar No. along with your PAN by providing a self attested copy with new proposal form.

Therefore who are buying new LIC products should no need to bother now. The process will be completed by LIC itself before issuing a new policy to you.

2. Link Aadhar / PAN to existing LIC Policies:

As I told you, as of now LIC did not came up any online linking facility to existing policies. However you can visit your branch and link Aadhar & PAN to LIC Policies. Do remember to get an acknowledgement of the same.

LIC has the main problem that they don' have any centralized system to manage all policies and customer. It will be little problematic if you have policies from different branch but if it is from same branch then it will be easy.

You can make a list of all your policies with other details like Insured Person Detail, Premium (without tax) along with a letter and self attested Aadhar copy along with PAN/Form 60 (If not provided earlier) and put request to the concerned authority/ LIC agent to do the same.

It is clearly stated in this circular that every person/entities has to link their Aadhar with all kind of insurance policies including Group Policies.

Aadhaar Number has to be captured for both Customer and Proposer.

In case where the Aadhaar number has not been assigned to a client, the client shall furnish proof of application of enrollment for Aadhaar.

The various entities and whose Aadhaar Number has to be captured is clarified as follows,

a. Individual : The Aadhaar Number of the Individual.

b. Company / Partnership / Trust :Aadhaar Number issued to the person holding an attorney to transact on the Company’s/Partnership’s/Trust’s behalf.

Click here to link your Aadhaar with LIC Policies

Or

if you want to link process manually/self by visiting branch, here is the Annexure (Application Format)

What is Form 60?

Click here to link your Aadhaar with LIC Policies

Or

if you want to link process manually/self by visiting branch, here is the Annexure (Application Format)

What is Form 60?

Form 60 is a self declaration provided as per requirement & filled by those individuals or person who does not have a PAN ( Permanent Account Number) and who enters into any transaction specified in Rule114B.

Who Require to provide Form 60?

Some person who have insurance policies but they do not earn as per Income Tax threshold limit then they can provide Form 60.

Before signing the declaration, this declarant should satisfy himself that the information furnished in this form is True, Correct and Complete in all respects. Any person making a false statement in the declaration shall be liable to prosecution under section 277 of the income tax act,1961 and on conviction be punishable.

HOW TO LINK STAR HEALTH INSURANCE POLICY WITH AADHAR NO.?

Here providing you the link. Click here. You will be asked for Policy No., fill up and submit it.

An OTP will be sent on your registered email ID and your registered Mobile No., fill OTP and submit.

Now provide your Aadhaar No. and PAN no. and submit.

A massage will prompt for successfully submission of PAN And Aadhaar No.

Don't go with any spurious call to help to link your Aadhaar with Policy.

Don't Share your personal details with any unknown person.

HOW TO LINK STAR HEALTH INSURANCE POLICY WITH AADHAR NO.?

Here providing you the link. Click here. You will be asked for Policy No., fill up and submit it.

An OTP will be sent on your registered email ID and your registered Mobile No., fill OTP and submit.

Now provide your Aadhaar No. and PAN no. and submit.

A massage will prompt for successfully submission of PAN And Aadhaar No.

Don't go with any spurious call to help to link your Aadhaar with Policy.

Don't Share your personal details with any unknown person.

I am very much pleased with this content thanks for sharing this blog.I appreciate your effort Thanks for sharing this blog.

ReplyDeleteHealth insurance

Dial to stay updated in the market #7869466071

This valuable information is very useful. Thanks for sharing your knowledge with us.

ReplyDeleteShare market tips

Great information. Click to learn about us Best LIC agents in Noida

ReplyDelete